Discover how we developed an AI-powered barbell tracking app that revolutionizes velocity-based training with zero additional hardware requirements.

Artificial intelligence and machine learning benefit the banking industry in multiple ways, from risk management to credit scoring.

Are you struggling to keep up with the growing threat of fraud? Space-O creates AI solutions for anomaly detection, pattern recognition, and predictive analytics. Using ML frameworks like TensorFlow and PyTorch, our custom systems identify suspicious behavior and prevent fraudulent activities.

Managing complex credit risks and market volatility in real-time can be daunting. We use data analytics and predictive modeling to train AI models with your risk profiles. Our custom risk management solutions enable enhanced stability and minimize financial losses.

Executing trades at the right time with fewer errors is challenging. Space-O helps financial firms by offering real-time market analysis and trend predictions. We use AI tools trained on extensive datasets to detect patterns and market trends for optimal trading decisions.

Businesses must tailor services to specific customer needs. We train AI solutions with LLMs like GPT-4 and BERT for customer behavior analysis. Space-O enables personalized services like custom loan offers and investment plans to augment customer relations.

Traditional credit scoring models rely on limited data, causing delays and missed opportunities. Our custom solutions use tools like Scikit-learn to analyze data from various sources to enhance traditional credit scoring by expanding loan access and accelerating approvals.

Do you need help automating the KYC and AML compliance processes? We use custom ML algorithms and NLP frameworks such as LSTM, ARIMA, and XGBoost to streamline data collection, analysis, and compliance verification processes for efficiency.

Changing market conditions and vast data analysis requirements hinder accurate forecasting of market trends and predicting investment opportunities. We streamline the process by building AI solutions using models like Prophet and VADER for real-time financial insights.

Space-O enhances customer interactions with AI-driven solutions using NLP models like Rasa, Dialogflow, and T5. Our custom-built AI systems reduce response times, cut operational costs, and improve customer satisfaction to deliver personalized support that meets your needs.

We specialize in developing AI-driven forecasting models using ML tools like Prophet and GBMs to provide reliable financial predictions. Our custom AI solutions help businesses manage resources, improve planning, and maintain stability in volatile market conditions that change.

Learn why Space-O should be your ideal choice for developing tailored AI solutions for your financial organization.

Our AI developers are experts in various AI fields such as data science, NLP models, neural networks, and machine learning algorithms with strong predictive analytics. Our developers utilize their expertise to develop versatile AI solutions for businesses in the financial industry.

We offer an extensive approach that includes AI consulting, model development, deployment, and ongoing support. Our end-to-end services ensure seamless implementation of AI solutions within your business for long-term success.

We have a team of UI/UX designers that prioritizes user-friendly interfaces and accessibility when building AI solutions. Our team ensures to provide AI-powered software that is powerful yet easy to operate to maximize adoption rates and enhance user experience.

Our developers comply with strict data privacy laws and adhere to industry regulations such as GDPR and PCI DSS during development. We perform all the necessary due diligence while developing and integrating AI solutions.

Our QA team thoroughly tests each AI software for parameters such as user acceptance, integrability, performance, quality, and security to ensure high performance and that no issues are lurking around when we hand over the project to your team.

We ensure clear, open communication throughout the project lifecycle by adopting a collaborative approach that values your input. Our transparent updates keep you informed at every stage, encouraging a successful partnership.

Space-O Technologies offers four engagement models to suit your project needs and budget. Choose the model that best fits your requirements.

Get a fixed contract value before starting the AI project development to make the resource allocation and payment process easier from the get-go. Our AI team offers start-to-end services in this model, from ideation to deployment and project handover.

In this model, you only pay for Space-O’s resources you use to complete your AI project. The time and material model helps you get a rough estimate and spend when developing AI software solutions for your financial organization.

We provide a streamlined hiring process for our pre-vetted AI engineers. With our dedicated developers model, you can build your team of AI developers and ML engineers to bring your AI vision to life.

If you already have AI engineers ready to work on your project, we can augment your staff and fill any skill gaps. We have a team of engineers ready to onboard and with on-site and off-site working experience to help your in-house developers.

As a market-leading AI software development company, we have expertise in working with the latest AI engineering technologies. We use this expertise to custom-develop game-changing AI software solutions for your business.

Programming languages

AI Models

Machine Learning and NLP

Frameworks and Libraries

Open-source AI and ML Platform

Toolkits

Neural Networks

Vector Database Management

Databases

Client Testimonial

Partnering with Space-O Technologies has stepped up our operations. Their AI-powered fraud detection solution reduced overall risks by over 60%, whereas the AI chatbot enhanced our customer services thanks to 24/7 availability. These solutions have helped us automate processes and mitigate fraud risks, hugely optimizing profits.

Don Mathews

Chief Technology Officer

We follow a reliable and tested software development process to ensure that our custom AI product meets your requirements and solves your business challenges.

A simple solution such as a customer support chatbot usually costs around $6,000 to $15,000, whereas banking software with basic functionality costs between $30,000 to $50,000. On the other hand, the cost of developing a robust predictive analytics solution ranges from $20,000 to as high as $100,000.

An advanced fintech app with complex features like real-time market data analytics, robo-advisory services, and advanced portfolio management may take 12 to 18 months from start to end. However, like the cost value, there are a lot of factors that determine the time it would take to develop an AI project for a financial institution.

Implementing AI in finance comes with challenges such as data quality, system compatibility, workflow disruption, and regulatory hurdles. At Space-O, we address such issues by providing tailored AI solutions while ensuring data privacy, data accuracy, seamless integration with legacy systems, and strict adherence to regulatory standards.

We provide regular updates through popular tools like JIRA, Asana, Basecamp, and Trello to keep you posted about any changes or developments from start to end. In case of a time-zone difference, we overlap common working hours to ensure our and your team can maintain consistency in communication.

Yes, we help businesses enhance their AI solutions. Our AI development services also include refining or enhancing an existing solution. We optimize the algorithms fine-tune its parameters, and retrain the model with new datasets to increase its efficacy and make it future-proof.

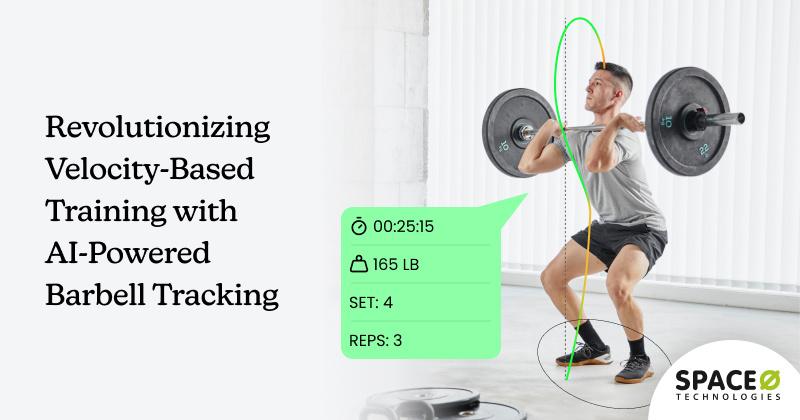

Revolutionizing Velocity-Based Training with AI-Powered Barbell Tracking

Discover how we developed an AI-powered barbell tracking app that revolutionizes velocity-based training with zero additional hardware requirements.

A Complete Guide to AI Agent Development: Key Steps & Best Practices

Refer to our complete AI agent development guide and learn how to build an AI agent from scratch, from key steps to challenges.

Top 10 Machine Learning Consulting Companies in 2025: Expert Analysis & Comparison

Explore top Machine Learning Consulting Companies of %currentyear%. Get expert analyses and insights into each firm's enterprise capabilities and specializations.