Discover how we developed an AI-powered barbell tracking app that revolutionizes velocity-based training with zero additional hardware requirements.

Recognized by industry leaders and backed by global standards, our credentials ensure trust and excellence in AI solutions.

Space-O develops custom AI banking solutions that address key challenges in the financial sector.

Fraud and cyber threats cause significant losses in FinTech. Space-O integrates advanced fraud detection systems using TensorFlow and Python to analyze real-time transactions, identify anomalies, and mitigate risks for secure banking operations.

Accurate credit risk assessment is essential for reliable lending decisions. Space-O develops predictive analytics models using tools like Scikit-learn to analyze vast customer data, enabling banks to make confident, data-driven, risk-free decisions.

Banks face challenges handling large volumes of customer inquiries. Space-O uses NLP tools like Dialogflow to build AI chatbots that provide seamless, personalized responses, enhancing customer satisfaction and streamlining interactions.

Manual underwriting is time-consuming and prone to errors. Space-O automates this process with AI solutions built using Keras, analyzing credit scores and risk profiles to reduce loan processing time and ensure accurate lending decisions.

Delivering personalized financial services can boost customer engagement. Space-O leverages NLP and ML to create AI solutions for businesses that analyze customer data, offering customized product suggestions and investment advice to enhance customer loyalty.

Meeting compliance requirements like KYC and AML is complex. Space-O automates compliance processes using AI tools that monitor transactions, ensure regulation adherence, and minimize compliance risks while reducing manual effort.

Manual tasks like data entry drain resources. Space-O’s RPA solutions automate repetitive banking operations, improving accuracy, cutting costs, and freeing up your team for more strategic, high-value activities.

Managing investments demands data-driven insights and personalized advice. Space-O develops AI platforms that analyze market data to deliver tailored recommendations, enhancing portfolio performance and strengthening client relationships.

Understanding customer sentiment is crucial for improving services. Space-O uses NLP to analyze reviews, surveys, and social media, offering actionable insights that boost customer satisfaction and help address concerns proactively.

At Space-O, we deliver intelligent, scalable AI solutions customized to the banking industry’s unique challenges, ensuring innovation, transparency, and compliance.

Our team of experienced AI developers understands the intricacies of the financial sector. From automated credit scoring to blockchain integration, we design AI solutions that drive efficiency and innovation in banking.

We ensure complete transparency at every step—through clear communication, rigorous quality checks, and milestone tracking—to deliver solutions that exceed expectations.

Our solutions comply with industry standards like GDPR and PCI DSS while adhering to local banking laws, safeguarding sensitive data, and ensuring legal compliance.

We follow an agile methodology, allowing us to adapt to market changes and client needs. This ensures timely delivery of flexible, scalable, and high-performing solutions.

Programming languages

AI Models

Machine Learning and NLP

Frameworks and Libraries

Open-source AI and ML Platform

Toolkits

Neural Networks

Vector Database Management

Databases

This model offers a fixed contract covering all the services and costs of your AI project. It’s ideal to clearly understand your project requirements during its development and implementation.

With this model, you pay only for the resources you use and the time spent. It’s perfect for ongoing AI projects, allowing us to support you flexibly during the development and implementation phases.

Hire dedicated developers from Space-O to manage your banking AI and machine learning projects. This model provides long-term support and specialized expertise without the need to build an in-house team.

If an in-house team is working on your AI project, this model helps you scale your resources as needed. Space-O’s staff augmentation ensures you meet complex project demands without committing to long-term investments.

Client Testimonial

Space-O’s custom AI solution for fraud detection and risk management significantly improved our security systems. Their team designed and implemented a machine learning model that reduced false positives by 45% and improved fraud detection accuracy by 32%. Additionally, the solution streamlined our KYC process and reduced onboarding time in half. We’ve seen a marked improvement in our efficiency and security processes thanks to Space-O’s AI expertise.

Chris Lunsford

CIO, TrustCapital

Our custom software development process ensures banking applications are built precisely and tailored to meet specific needs.

Simpler AI solutions, such as automating customer service chatbots, data processing, or fraud detection using existing models, take 2 to 6 months to develop. On the other hand, complex solutions, like personalized banking services, credit scoring models, or predictive analytics systems, can take as long as over 1 year before implementation.

We prioritize data security and ensure compliance with suitable financial regulations such as GDPR, PCI DSS, and local data protection laws. We design AI solutions with strong encryption, access controls, and audit trails to safeguard sensitive financial data.

Pre-built solutions are convenient and cost-effective, offering quick deployment and general features for common use cases. On the other hand, custom-built AI solutions provide tailored functionality, greater flexibility, and seamless integration with existing systems. Custom-built solutions also address specific business needs and deliver more accurate, personalized outcomes that pre-built solutions can’t offer.

We design custom AI solutions with suitable modular architectures and cloud-based infrastructure to ensure scalability and adaptability, allowing the solution to change as your customer base or data grows. Our solutions leverage popular platforms like AWS or Google Cloud to handle increased transaction volumes and evolving business needs.

Your team’s involvement is crucial for the project’s success. We collaborate closely with you to gather initial requirements, provide feedback on development stages, and make decisions throughout the process. Regular communication with you helps us develop a solution that meets your expectations and solves your business challenges.

We follow an iterative approach to AI solutions development that allows us to accommodate revisions and the flexibility to adapt to new requirements. We follow a structured change management process to align modifications with overall project goals without impacting timelines or quality.

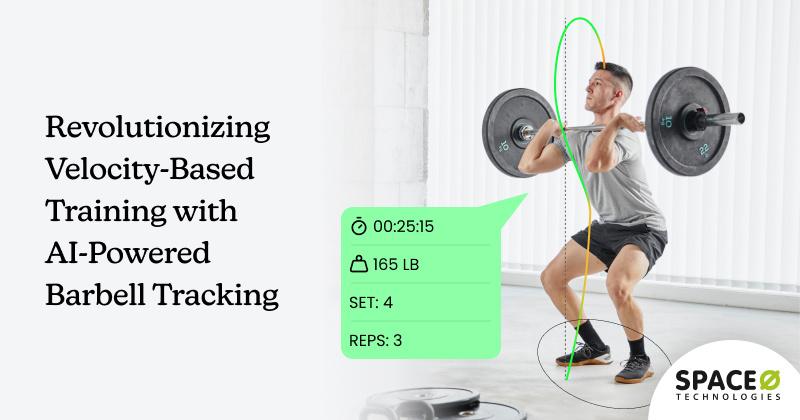

Revolutionizing Velocity-Based Training with AI-Powered Barbell Tracking

Discover how we developed an AI-powered barbell tracking app that revolutionizes velocity-based training with zero additional hardware requirements.

A Complete Guide to AI Agent Development: Key Steps & Best Practices

Refer to our complete AI agent development guide and learn how to build an AI agent from scratch, from key steps to challenges.

Top 10 Machine Learning Consulting Companies in 2025: Expert Analysis & Comparison

Explore top Machine Learning Consulting Companies of %currentyear%. Get expert analyses and insights into each firm's enterprise capabilities and specializations.